Claim Short-Settled

We purchase insurance with the expectation of receiving full coverage when needed. However, there are instances where the claim amount provided may fall short, which can be frustrating. At DR BIMA CLAIM REJECTED BAZAAR , we assess your situation and work diligently to help you secure the maximum claim amount from the insurance company.

What is Claim Short-Settled?

In insurance, a claim short-settled occurs when the insurer provides a payment to the policyholder that is less than what is due according to the policy terms. It is crucial to address any issues related to a short-settled claim promptly to ensure you receive fair and appropriate compensation.

Hassle-Free Process

Experience a streamlined process for filing your detailed claim form accurately, minimizing any potential back-and-forth with the insurance company.

Simplified with Expert Guidance

Filing a claim is made straightforward with our expert assistance. Our app offers a detailed list of dos and don’ts to ensure a smooth and hassle-free claims process.

Automatic Analysis

DR BIMA CLAIM REJECTED BAZAAR will automatically analyse your uploaded policy document to extract essential information, which will then be entered into the claim form.

Why Consult a DR BIMA CLAIM REJECTED BAZAAR Specialist?

Skilled Professionals

Our team of industry specialists will meticulously assess your case and provide comprehensive guidance to ensure you receive the maximum claim amount possible.

Claim Assistance

We are committed to advocating for you throughout every step of the process. Obtain expert assistance with claims for life insurance, health insurance, and general insurance.

Trustworthy

We are dedicated to crafting tailored solutions for your case, ensuring that your insurance rights are preserved through careful consideration of your concerns.

Trusted by these amazing peoples

Testimonials

4.9

"Hi iam hemlata wife of sohanlal had gone through lot of struggle after my husbands sudden demise .my husband had taken a insurance but the insurance company denied to pay the amount which was 25 lacs thanks to bima bewakoof who assured us that the insured amount would be recovered when all others had backed off and today as said it has happend we got the recovery amount of 25lacs I am very thankful to bima bewakoof for helping us at the time we had almost given up guys if anyone has any problem related insurance do contact bima bewakoof."

Sohan Choudhary

"I had mistakenly entered the wrong nominee details in my health insurance policy. Thanks to Bima Bewakoof’s 'Know Your Policy' feature, I caught and corrected the error just in time. Their team was prompt and supportive!"

Rakesh Mehta

"My mediclaim was stuck in processing for over 4 months. I had almost given up hope, but DR Bima Claim Rejected Bazaar got involved and the insurance company released ₹1.2 lakhs within 3 weeks. I’m extremely grateful!"

Suhani Verma

"An agent mis-sold me a ULIP plan disguised as a term policy. I reached out to Bima Bewakoof, and they helped me file a formal complaint. Not only did I get my ₹75,000 back, but I also learned how to read policies better."

Manoj Pillai

"My maternity-related claim was unfairly denied citing a waiting period clause. DR Bima stepped in, reviewed my documents, and helped me get ₹48,000 approved. True lifesavers!"

Priya Narang

"After my father passed away, the insurance company kept delaying the term claim. We were emotionally and financially drained. Bima Bewakoof fought for us and recovered ₹50 lakhs. We owe them our peace of mind."

Rohit Sharma

My brother met with an accident, and the accidental claim was being denied over some unclear clause. DR Bima interpreted the policy and sent a strong representation. The claim was finally approved — ₹1.5 lakhs!"

Deepak Joshi

"Filing reimbursement claims used to stress me out. Their reimbursement tool made the whole process easy. I submitted everything in one go and got ₹32,000 credited in just 9 working days."

Sneha Rajan

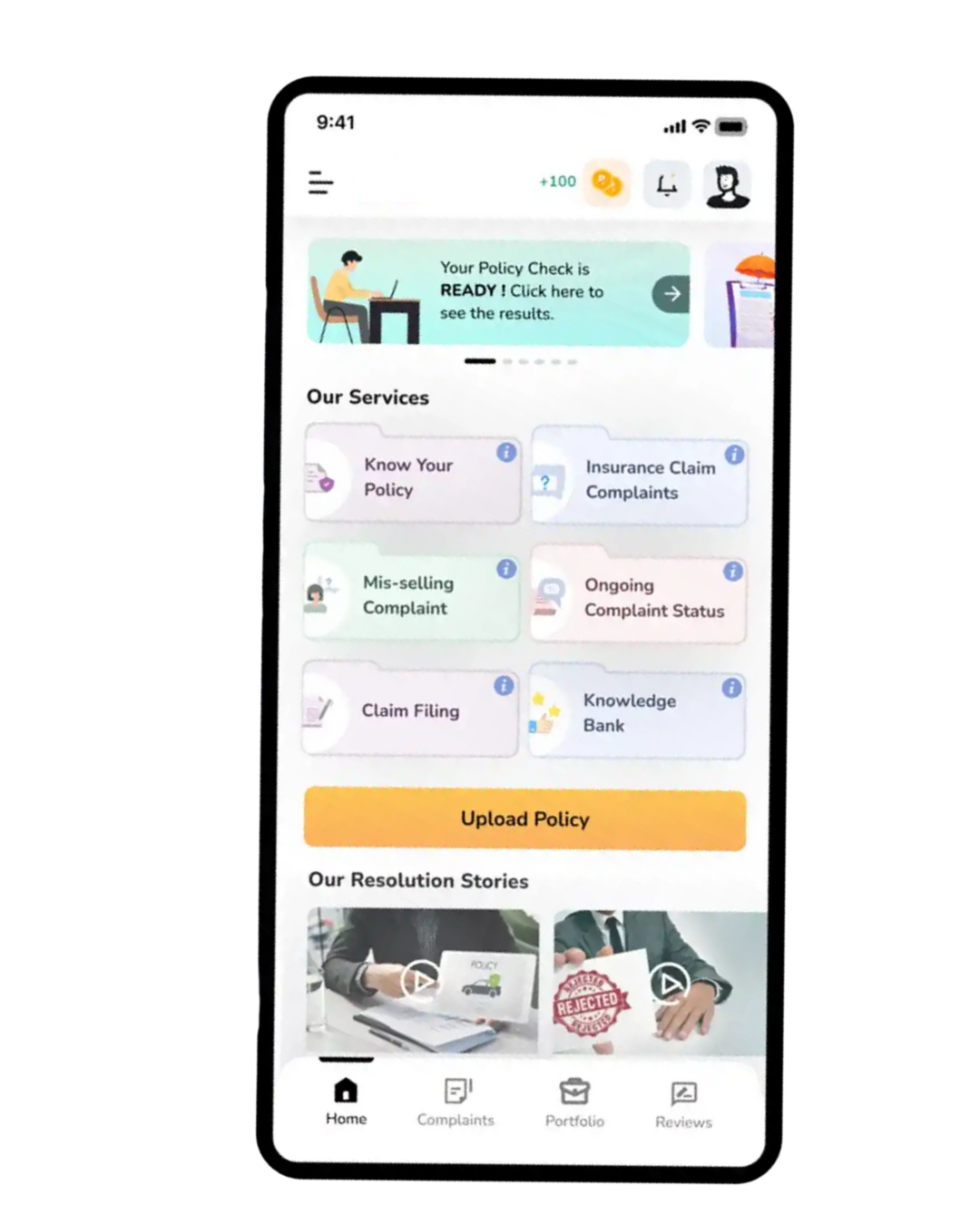

Coming Soon!

Bima Bewakoof App!

Streamline your insurance experience with a single tap. Easily update your details in your insurance company’s records.

Update your details in the insurance company records

Get insider tips for successful Health Claim Reimbursement

Download the Bima Bewakoof App today! Access expert tips for successful health claim reimbursement, understand your policy thoroughly, and verify if there are any errors in your policies.

File your complaint with us today!

Register an online complaint so that our industry experts get in touch with you to give you the best advice.

Frequently Answered Questions

Insurance policies can be wrongfully sold in various ways. Here are some common examples:

- Promising an interest-free loan as part of a mortgage or insurance plan.

- Offering free health insurance as an incentive.

- Selling insurance disguised as a fixed deposit at a bank.

Insurance claims can be rejected for several reasons, including delays in health claim reimbursement, policy exclusions, non-disclosure of pre-existing conditions (PED), and more. It's crucial to be aware of these factors to avoid claim rejections.

Yes, a claim may be delayed if pre-existing conditions are involved, particularly if the insurance company needs to review the policyholder's medical history or gather additional information from healthcare providers.

Yes, you can resubmit a short-settled claim for further payment.

You can use the 'Know Your Policy' feature on our mobile application "DR BIMA CLAIM REJECTED BAZAAR" to upload and review your complete policy document. This tool helps identify any errors or inconsistencies that could lead to claim rejections or delays in the future.

We assist in representing your case with the Insurance Company, Insurance Ombudsman (Bima Lokpal), or consumer court, depending on the specifics of your situation.

Once your case is accepted and registered, you can receive real-time updates through the DR BIMA CLAIM REJECTED BAZAAR App.

Yes, a one-time registration fee of INR 1000 (including GST) is applicable for all life, health, and general policies for you and your family members once your case is accepted.

Upon successfully resolving your insurance complaint, we charge one fifth on successfully resolved amount of claim as service fee, plus GST.

The duration of resolving an insurance-related issue depends entirely on the specifics of the case. We recommend being patient throughout the process.

You may need to attend an Insurance Ombudsman hearing when your case is scheduled for representation.

Pre-hospitalization expenses, typically incurred 30 days before admission, and post-hospitalization expenses, generally covered for 60-90 days after discharge, are included in most medical policies. We assist with your reimbursement process for a nominal fee of INR 1000, relieving you of the hassle of filling and submitting claim forms.

Yes, it’s crucial to disclose your smoking or alcohol consumption habits when purchasing insurance. Failing to do so is unethical and could lead to claim rejection.

Typically, there is a waiting period of 30 days from the start date of the insurance policy before you can file a claim.

If you're admitted to a non-network hospital, you will usually need to pay the bills upfront and then seek reimbursement from your insurance company afterward.

We assist in representing your case with the Insurance Company, Insurance Ombudsman (Bima Lokpal), or consumer court, depending on the specifics of your situation.

Once your case is accepted and registered, you can receive real-time updates through the DR BIMA CLAIM REJECTED BAZAAR App.

Yes, a one-time registration fee of INR 1000 (including GST) is applicable for all life, health, and general policies for you and your family members once your case is accepted.

Upon successfully resolving your insurance complaint, we charge one fifth on successfully resolved amount of claim as service fee, plus GST.

The duration of resolving an insurance-related issue depends entirely on the specifics of the case. We recommend being patient throughout the process.

You may need to attend an Insurance Ombudsman hearing when your case is scheduled for representation.

Pre-hospitalization expenses, typically incurred 30 days before admission, and post-hospitalization expenses, generally covered for 60-90 days after discharge, are included in most medical policies. We assist with your reimbursement process for a nominal fee of INR 1000, relieving you of the hassle of filling and submitting claim forms.

Yes, it’s crucial to disclose your smoking or alcohol consumption habits when purchasing insurance. Failing to do so is unethical and could lead to claim rejection.

Typically, there is a waiting period of 30 days from the start date of the insurance policy before you can file a claim.

If you're admitted to a non-network hospital, you will usually need to pay the bills upfront and then seek reimbursement from your insurance company afterward.